VAT & Invoicing

The tax authorities have made international invoicing significantly easier. Certain mandatory VAT information may now also be used on invoices in Germany in other official EU langu

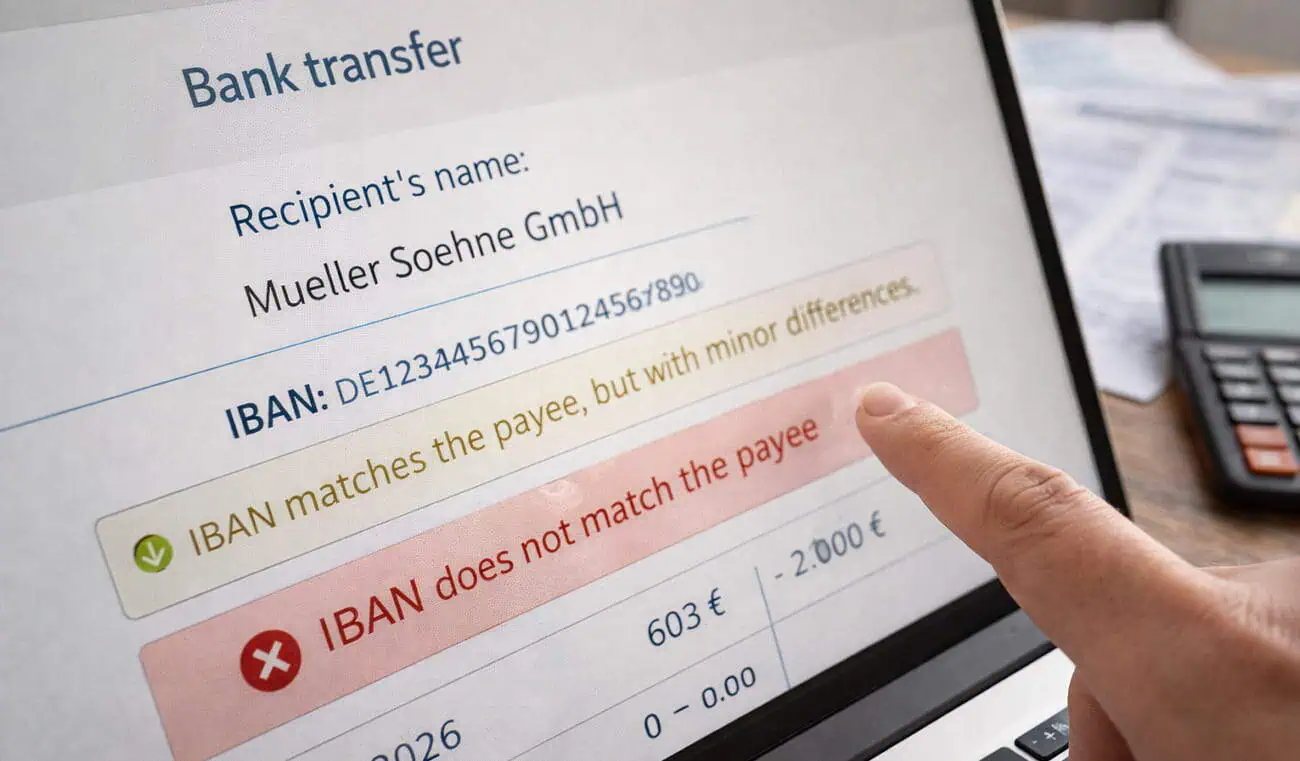

Verification of Payee (VoP)

Since the end of 2025, a new binding standard has been in force across European payment transactions, fundamentally changing the handling of SEPA transfers. With the introduction o

Minimum Wage Increase from 2026

As 2025 draws to a close, one of the most significant labour market changes of recent years is about to take effect. From 1 January 2026, the next stage of the statutory minimum wa

Understanding Christmas Bonuses

By mid-December, many companies have already completed the accounting and payroll processing of year-end bonuses. In most cases, Christmas bonuses are paid together with the Novemb

Corporate Christmas Events

With the beginning of December, many companies enter the peak season of year-end events. Christmas parties are among the most important internal gatherings to bring teams together,

Christmas gifts for employees and business associates

With the start of Advent, many companies are focusing on their annual gift-giving season. Whether it's a small token of appreciation for business partners or a seasonal gesture of

Artists’ Social Insurance

The German Federal Ministry of Labour and Social Affairs has announced that the contribution rate to the Artists’ Social Insurance Scheme will be reduced from 5.0% to 4.9%, effec

VAT special audits

Companies operating in Germany need to be especially vigilant in managing their VAT: Recent figures from the German tax authorities show that special VAT audits alone in 2024 led

Paid Holiday Bonus in Germany

The paid holiday bonus is often seen by employees as a one-time financial benefit added to their salary. However, in Germany, this payment is not mandatory by law and is fully taxa

VAT Consequences of Transfer Pricing Adjustments

For a long time, it was generally assumed that value-added tax (VAT) and transfer pricing operate independently and do not affect one another. However, in their efforts to increase