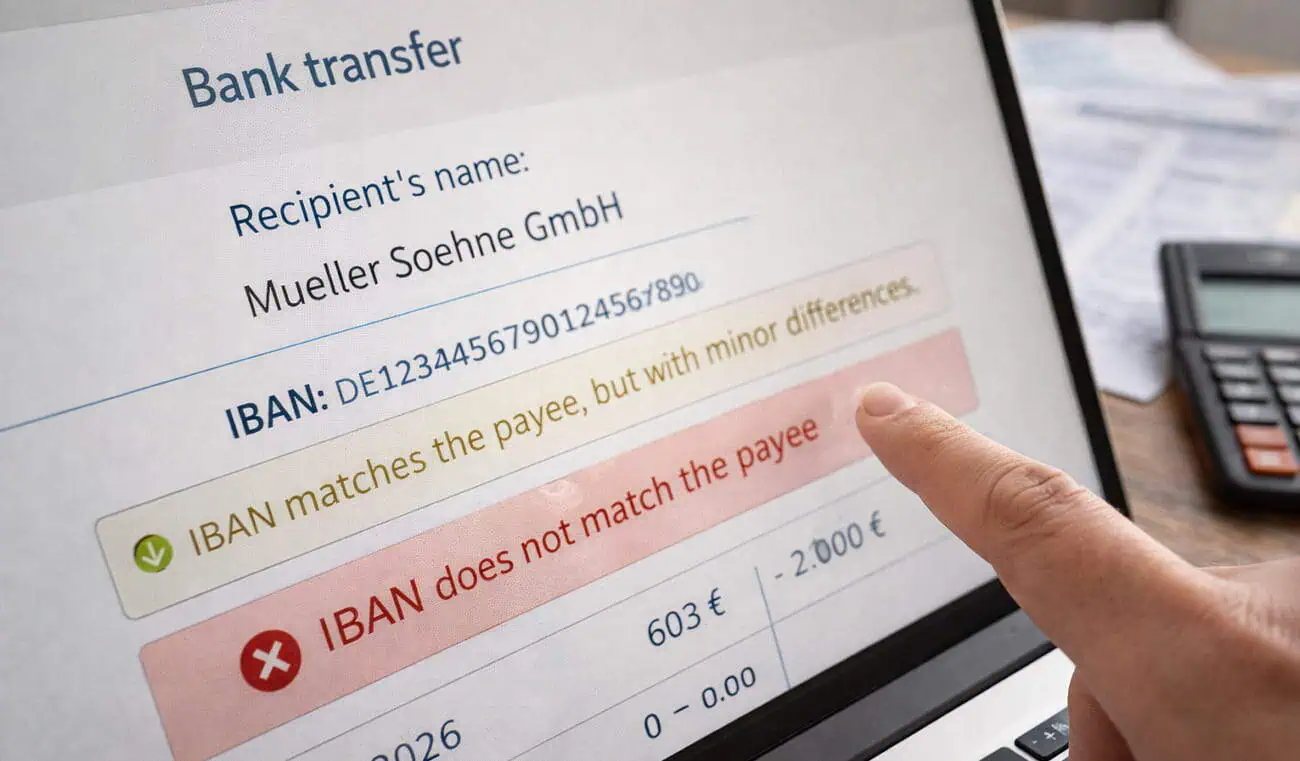

Verification of Payee (VoP)

Since the end of 2025, a new binding standard has been in force across European payment transactions, fundamentally changing the handling of SEPA transfers. With the introduction o

Minimum Wage Increase from 2026

As 2025 draws to a close, one of the most significant labour market changes of recent years is about to take effect. From 1 January 2026, the next stage of the statutory minimum wa

VAT Consequences of Transfer Pricing Adjustments

For a long time, it was generally assumed that value-added tax (VAT) and transfer pricing operate independently and do not affect one another. However, in their efforts to increase

Taxation of French Civil Service Pensions

The German tax authorities have recently clarified how French civil service pensions are to be treated under the Franco-German Double Taxation Agreement (DTA). A consultation agree

How are companies classified in Germany?

In Germany, companies are classified based on their size according to the German Commercial Code (HGB). This classification is particularly important for businesses planning to est