VAT & Invoicing

The tax authorities have made international invoicing significantly easier. Certain mandatory VAT information may now also be used on invoices in Germany in other official EU langu

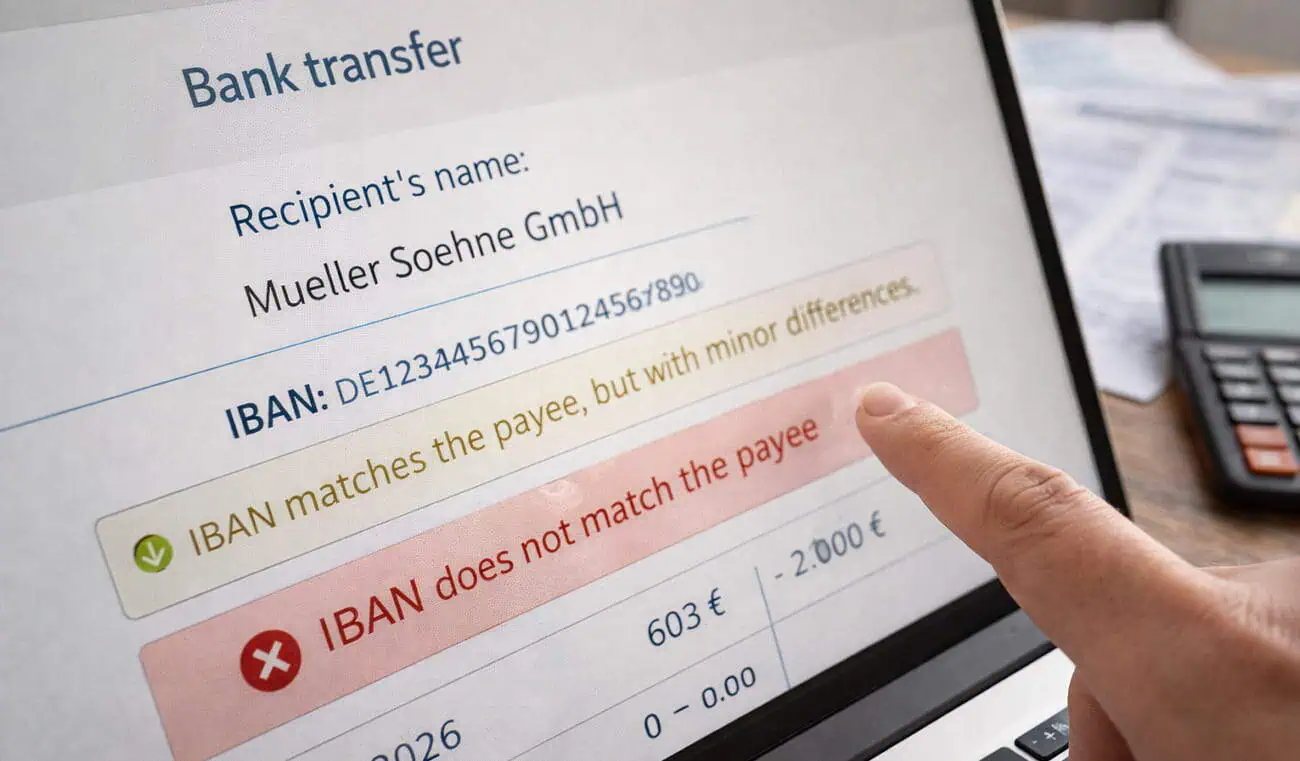

Verification of Payee (VoP)

Since the end of 2025, a new binding standard has been in force across European payment transactions, fundamentally changing the handling of SEPA transfers. With the introduction o

VAT Consequences of Transfer Pricing Adjustments

For a long time, it was generally assumed that value-added tax (VAT) and transfer pricing operate independently and do not affect one another. However, in their efforts to increase