Verification of Payee (VoP)

New Mandatory Checks for SEPA Payments Since Late 2025

Since the end of 2025, a new binding standard has been in force across European payment transactions, fundamentally changing the handling of SEPA transfers. With the introduction of Verification of Payee (VoP), banks are now required to automatically verify for each SEPA transfer whether the specified payee name matches the corresponding IBAN. The objective of this regulation is to reduce misdirected payments and significantly lower the risk of payment fraud.

At the beginning of 2026, its practical impact is already evident: the new verification logic directly affects payment processes, accounting workflows and cash flow management—particularly for companies with high transaction volumes or complex master data structures.

Background of the new regulation

Verification of Payee, also known as the IBAN name check, is an EU-wide regulatory measure that has been mandatory since 9 October 2025. The technical implementation began shortly before the effective date, enabling real-time name and IBAN verification.

The check applies to all SEPA transfers, regardless of whether they are initiated by companies or private individuals and irrespective of the banking software or financial institution used.

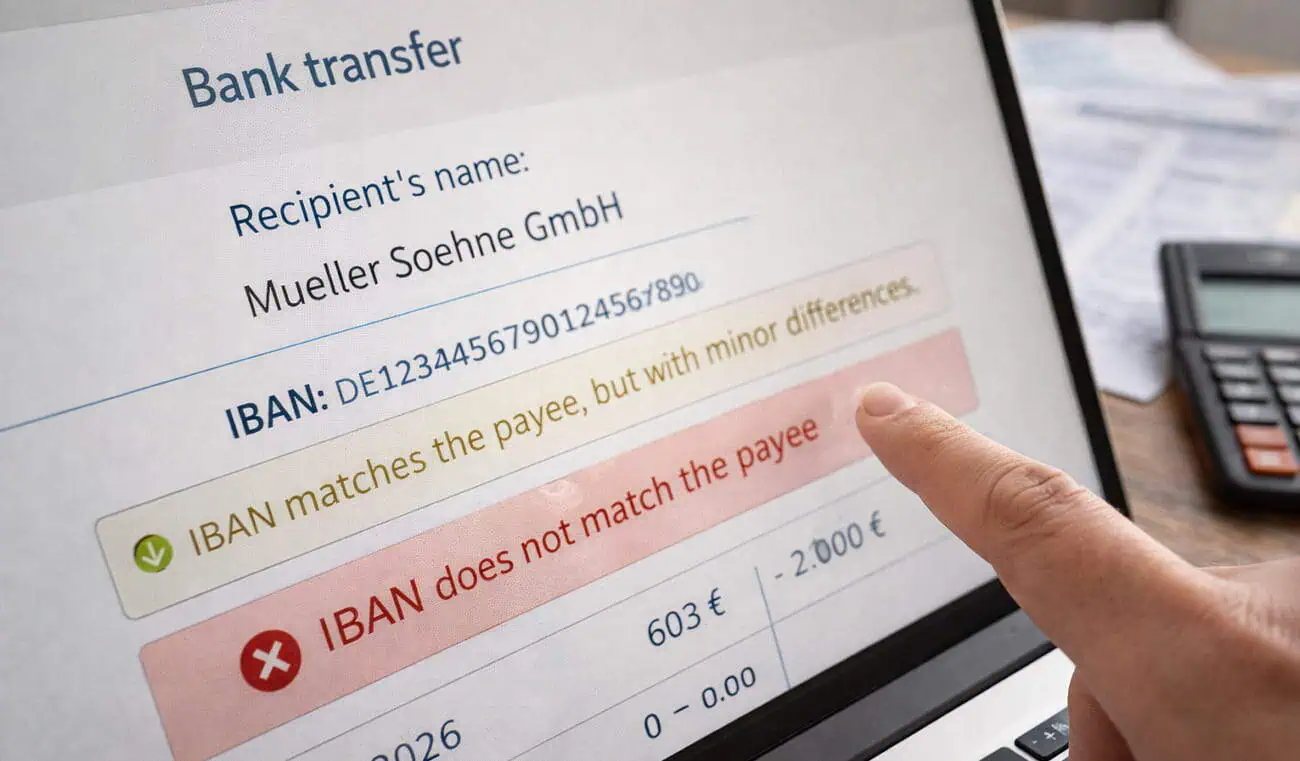

The traffic light system used by banks

The result of the verification is displayed immediately and follows a standardized traffic light system:

- Green: Name and IBAN match – the payment is executed as normal

- Yellow: Minor discrepancies (e.g. spelling differences or alternative name formats)

- Red: No match between the name and the IBAN

This feedback is provided before the transfer is executed, allowing the payer to make an informed decision.

Typical practical challenges

In practice, companies in particular encounter recurring issues such as:

- Abbreviations or missing legal form suffixes (e.g. “Ltd”, “GmbH”)

- Name changes of companies or individuals

- Different spellings, special characters or umlauts

- Outdated or incomplete master data

Example:

A company is officially registered with the bank as “Müller & Söhne GmbH”, while the invoice states “Müller Söhne”. This discrepancy may trigger a yellow or red warning, potentially delaying or interrupting the payment process.

Verification process for SEPA transfers

- Green: Transfer is executed automatically

- Yellow: The bank displays the registered payee name; the payer decides whether to proceed

- Red: No match detected; the payer must actively decide whether to continue or cancel

Banks may differ in how strictly they handle deviations. As a general rule, liability for incorrect payee details lies with the payer. The bank assumes responsibility only if a confirmed match exists.

Impact on companies

The VoP requirement has tangible operational consequences:

- Cash flow management: Payments may be delayed due to incorrect or inconsistent payee names

- Invoicing and accounting: Consistent, bank-compliant company names become essential

- Supplier and customer communication: Clear guidance on the exact registered name is increasingly important

Companies with numerous suppliers, international payment flows or historically grown data structures are particularly affected.

Benefits of Verification of Payee

Despite the initial adjustment effort, the regulation offers clear advantages:

- Reduction of misdirected payments and fraud

- Fewer manual corrections and follow-up inquiries

- Immediate feedback on data accuracy

- Strengthening of internal payment controls and processes

Recommendations for companies

To avoid disruptions in payment processing, a structured approach is advisable:

- Review and standardize company names across all banks

- Issue invoices accurately and completely, including legal form

- Regularly validate supplier and customer master data

- Adapt ERP systems and payment software to VoP requirements

- Train employees, particularly in accounting and payment processing

- Define internal procedures for handling yellow or red alerts efficiently

Conclusion

Verification of Payee is not merely a technical adjustment, but a new standard in European payment transactions. Companies that proactively ensure consistent master data and clear internal processes reduce operational risks, safeguard cash flow and benefit from more efficient payment handling in the long term.

If you require support in implementing VoP, reviewing your processes or adapting ERP and payment structures, we are happy to assist with practical expertise.

If you have further questions, our accountants will be happy to provide you with personal advisory. Additionally, we are available to advise you throughout France and Germany by phone and video conference. Your Franco-German tax consultancy FRADECO.

Disclaimer

Although the greatest possible care has been taken in the preparation of this newsletter, we reserve the right to make changes, errors, and omissions. The abstract legal presentation in this newsletter is no substitute for individual civil and tax law advice on a case-by-case basis. Subsequent changes to the legal framework, the views of the German or French tax authorities or case law, including with retrospective effect, are possible.